What does RESCI offer?

Current Performance of RESCI:

Current Investment Capacity

How much capital can we accept at the moment based on our secured bonds?

Partner Capital Under Management

How much money have we raised and is deployed on our secured bonds?

Average Return to Investors

What is the current average return on capital per year being paid to our partners?

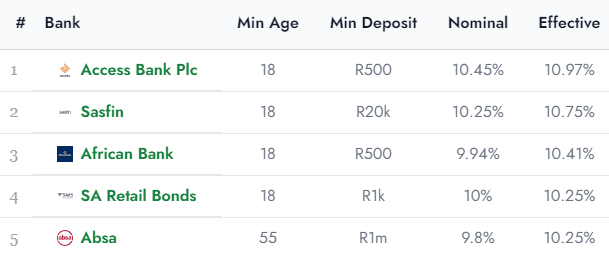

What are the 5 best 5-year bank investment rates for 2024?

- Safety: Bank deposits, such as savings accounts or certificates of deposit (CDs), are typically insured up to a certain limit by government agencies, which means your principal is protected.

- Predictable returns: Bank deposits offer relatively stable and predictable interest rates, providing a sense of security.

- Low returns: The interest rates on bank deposits are usually lower than the potential returns from other investment options, often not keeping pace with inflation.

- Limited growth: Your money may not grow significantly over time, especially after factoring in inflation and taxes.

- Illiquidity: Your funds are fixed for 5 years, with severe penalties for early extraction.

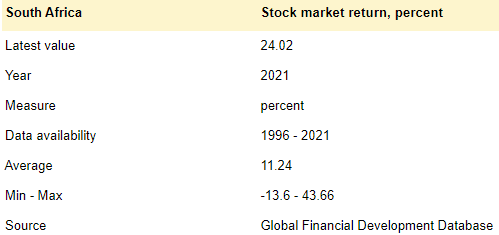

What are the average stock market return?

- High potential returns: Stocks have historically offered higher returns over the long term compared to other asset classes.

- Liquidity: Stocks are highly liquid, and you can buy or sell them easily on stock exchanges.

- Diversification: Investing in a variety of stocks can help spread risk and potentially provide more stable returns.

- Volatility: Stock prices can fluctuate widely, leading to potential losses in the short term.

- Risk: There is no guarantee of returns, and you can lose your entire investment if the stock market experiences a downturn.

- Expertise required: Successful stock market investing often requires knowledge, research, and ongoing monitoring.